You’re probably somewhat aware of your personality type: whether you’re an introvert or an extrovert, a control freak or totally laid back. But did you know you have a money personality type too?

We each have our own tendencies that make up our money personality as a whole. You may not notice, but this plays out in real life all the time.

Think about a time when you’ve been out to dinner with a group of friends. When it comes time to pay the bill, some people in the group are great with splitting the check evenly, while others at the table cringe because they just want to pay for their order. That can get a little awkward, but it’s just because everyone is wired differently. So, let’s talk about your money tendencies.

What Is a Money Tendency?

Your money personality is made up of seven tendencies that identify how you handle money.

I’ve identified these tendencies in my new book, Know Yourself, Know Your Money. They are:

- Spender or Saver

- Nerd or Free Spirit

- Experiences Person or Things Person

- Quality Person or Quantity Person

- Safety Person or Status Person

- Abundance Person or Scarcity Person

- Spontaneous Giver or Planned Giver

These tendencies are specific to how we deal with money. You likely lean toward one or the other of each tendency, but don’t overthink it. It’s a spectrum, so you might be somewhere in between.

You’re wired to think and act in certain ways, and while none of the tendencies are right or wrong, they do have implications. Understanding them will help you make faster progress on your financial goals. So, let’s dig into them!

Spender or Saver

Spenders

They see so many creative possibilities when it comes to money. Whenever they have extra money, it’s burning a hole in their pocket and they can’t wait to spend it. Spenders have a healthy appreciation for spending money, and generosity might come more easily to someone with this money personality type.

Challenge for Spenders: If you’re a spender, you need to prioritize saving too.

Savers

They would rather keep their money tucked away for a rainy day. Putting money away for the future isn’t a huge sacrifice for them. It gives them a sense of security. They’re patient, responsible and willing to wait. They also may be more likely to experience buyer’s remorse.

Challenge for Savers: If you save everything you make, you’re going to miss out on a lot of fun experiences that make life worth living.

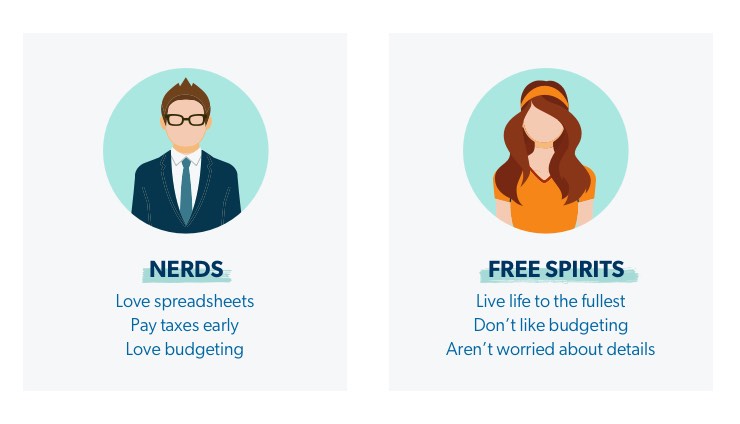

Nerd or Free Spirit

Nerds

They have their tax return prepared for the dreaded April 15 deadline well in advance. Spreadsheets, amortization charts and the budget make them feel in control of their money—which they love. They’re laser-focused on what they need to do to win with money, and they’re on top of the details and decisions.

Challenge for Nerds: If you live and die by the rules and the budget, you end up wearing out yourself and your family.

Free Spirits

Tax Day is when? If this sounds more like you, you’re probably a free spirit. When it comes to money, they have a “let’s enjoy life” mentality. Just reading the word budget would make this money personality break out in hives.

Challenge for Free Spirits: If free spirits aren’t intentional about their money, they’ll look up in a few years and wonder where on earth it all went.

Experience or Things

Experience People

This part of your money personality is all about what you value in life. If you’d rather spend your money on experiences, like travel, concerts or a day at the spa, you’re a person who values experiences. I love experiences, and I prefer to spend my money on eating dinner out or going to a movie rather than anything tangible.

Things People

If you tend to spend money on physical things, like clothes, shoes or the latest piece of technology, then you’re a person who values things. My husband, Winston, is like this, and his Christmas lists have included things like hunting gear and an adult-sized scooter.

Get Rachel Cruze’s new book to learn why you handle money the way you do!

Challenge for both: They’re both equally valid preferences. If you’re married, ask your spouse if they’d rather have an experience or a thing. After Winston and I figured this out, it helped us in our budgeting, gift-giving and communication.

Quality or Quantity

Quality People

This money personality type wants things that are going to last longer. I find that people who value quality will research and plan their purchases beforehand. Quality spenders don’t tend to be impulse shoppers.

Challenge for Quality People: Ask yourself if it’s really necessary to spend more, or if there’s a less expensive option you would enjoy just as much.

Quantity People

They enjoy the creativity and possibility that variety offers. You like having ten options versus going back to the same thing over and over. People who lean toward quantity are often great bargain shoppers. They pride themselves on the art of a great deal.

Challenge for Quantity People: If you struggle with overdoing it on quantity, consider taking the Minimalists’ challenge to give you a different perspective.

Safety or Status

Safety People

People who value safety as part of their money personality want the security that money can bring. They want to know they can withstand job loss, a medical emergency or even just a dip in income.

Challenge for Safety People: Don’t let a safety mindset keep you living in fear. As you make money decisions, make sure you’re seeing and considering all of the possibilities, not just defaulting to the choice with the least amount of risk.

Status People

Someone with this kind of money personality is more likely to value a name-brand purse or luxury vacation. They’re also more likely to find a way to justify a larger purchase if, on some level, it makes them feel seen as successful.

Challenge for Status People: Knowing that you have that status tendency means you’ve got to keep your spending and your heart in check. The stuff you own doesn’t define you as a person.

Abundance or Scarcity

Abundance People

People who live in an abundance mindset believe there’s always more than enough for everyone. They tend to take more risks and don’t fear the outcome of a decision. They also tend to be natural givers, believing there will always be a way to make more money!

Challenge for Abundance People: This glass-half-full mentality can interfere with making wise choices with money. If this is you, seek the advice of family and friends you trust before making a big purchase (even if it’s for someone else).

Scarcity People

People who operate under the assumption of scarcity make money decisions based on a belief that resources are finite. They hold onto possessions tightly because they “might need that someday.” And sometimes they fear losing things because they might not be able to replace them.

Challenge for Scarcity People: Don’t miss smart financial opportunities that will move you forward in life because fear is undermining your thinking. Always remember this: God will provide for you. There are no limits to his goodness and ability.

The abundance/scarcity tendency is one of the tendencies covered in my new personality quiz! Find out which tendency you lean toward here.

Spontaneous Giver or Planned Giver

Spontaneous Givers

People with this tendency in their money personality are quick to give. If they pass someone on the sidewalk asking for a donation, they jump at the chance. They love having the freedom to respond with their heart.

Challenge for Spontaneous Givers: Dropping $5 in a bucket here and there can feel good in the moment, but it may not have the impact you think it does. Emotional giving definitely isn’t wrong—just remember that if it’s the only way you give, you may miss opportunities that have larger impact.

Planned Givers

Typically, planned givers take their resources and money very seriously. They don’t give to every good cause they hear about because they’ve already decided where they’re giving, and they’ve committed to it. They also avoid giving to individuals or nonprofits they haven’t researched.

Challenge for Planned Givers: If this is how you’re wired, try to leave room in your giving line item for the unexpected. You might find a lot of joy in blessing someone who isn’t expecting it.

It Pays to Know Your Money Tendencies

Now that you know your natural tendencies and their challenges, you can make better decisions for yourself and become more balanced. And remember: No part of your money personality is right or wrong—it just shows us how we’re wired.

For example, if you’re a spender, make sure you’re following a budget and setting aside savings too. If your spending is out of control and your savings account is empty, this is an area you need to work on.

Guys, if you’ll really work these 7 Money Tendencies, you’re going to see progress! You can get to a healthier money personality. The more you pay attention to why you spend (or don’t spend!) money the way you do, the more you can course-correct when you need to. Don’t put this off. In one year or five years or 10 years, you’re going to look back and be so, so grateful you started today.

I want to help you get to the root of all of your decisions—your mindset, your behaviors and your beliefs—so you can make real progress with your money. You can learn your 7 Money Tendencies in my new Know Yourself Money Assessment. In this personalized, practical assessment, you’ll also understand your:

- Money Profile and Beliefs

- Money Classrooms

- Money Fears

- Money Motivations

- Attitudes and Actions around money

Take my Know Yourself Money Assessment!

Get over 30 pages of in-depth, personalized insights about you and your money.

Get the Assessment

Read the full article here