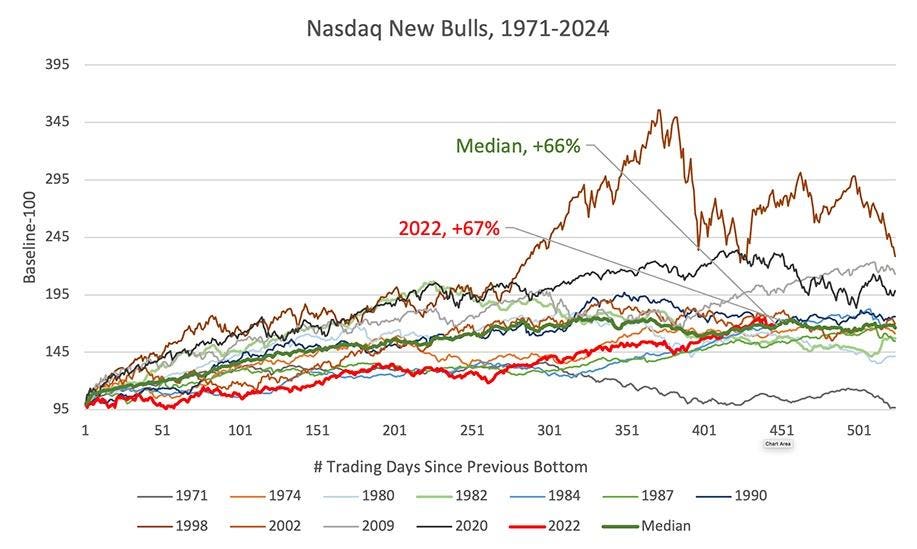

Since the general equity market lows in late-2022, stock indices got off to a slow start, generally lagging their typical new bull market starts. More recently, the Nasdaq has finally caught up to its median price performance for a bull market after nearly 450 days into the uptrend. It had lagged consistently up until a sharp move higher beginning in April 2024. This can be seen below in Figure 1 (Note: all data throughout is sourced from O’Neil Global Advisors unless otherwise noted).

Figure 1: Nasdaq Bull Market Comparisons, 1970-2024

However, this recent surge in the Nasdaq has been driven mostly by the mega-cap stocks and the Technology sector. The top-10 market cap names are up an average of 164% since the beginning of 2023, and that is even after most trading off their highs by over 10% in July. Compare this to the equal-weight S&P 500, which is up just 20% over the ~19-months as demonstrated in Figure 2.

Figure 2: Top-10 S&P 500 Market Cap Stocks

Figure 3 shows the O’Neil Technology sector (market-cap weighted) performance versus the S&P 500 over a trailing 18-month period, going back to 1970. There had been three prior periods where the outperformance topped 50%, in 1972, 1999-2000, and most recently, through June of this year. Over a few weeks the spread has now decreased to 36% but clearly is still at an extreme level.

Figure 3: Technology Relative Performance versus S&P 500

Small-cap stocks have seen a very different trajectory (Figure 4). The Russell 2000 has dramatically lagged the new bull markets from 2002 and 2009. In fact, only a week ago did the Russell 2000 even cross the threshold that we typically consider as confirmation of a new bull market: a gain of +30% from previous lows.

Figure 4: Russell 2000, Bull Market Comparison

Figure 5 shows the Russell 2000 versus the concentrated Nasdaq-100 over trailing 18-month periods since the Russell 2000 inception in 1987. The magnitude of recent small cap underperformance has been the worst since the first internet bubble!

Figure 5: Russell 2000 Relative Performance versus Nasdaq 100

Our good friend Jim Furey runs a premiere independent small-cap research firm, Furey Research Partners. His intensive work corroborates how dire the small-cap versus mega-cap lag has been. In Figure 6, Jim shows the Russell 2000 total market cap as a percentage of the S&P 500 total market cap since 1987. It has never been lower in the last 37 years.

Figure 6: Russell 2000 Market Cap as a % of S&P 500 Total Market Cap

Beyond small caps’ performance gap to fill versus large caps, there is also recent positive precedent from the huge Q4 2023 rally in small caps.

Revisiting our December 2023 investment report:

- The Russell 2000 rallied 20% in just the past seven weeks. While such a move is not unprecedented, it is fairly rare. Since the index inception in 1987, it has rallied 20% or more in any trailing seven-week (35 trading day) period 77 times. This is less than 1% of the time. Also, many of the instances are bunched together (e.g., after 2009 and 2020 lows). What immediately stands out is just how strong the forward gains are in most cases. There is only one instance where forward returns are clearly negative, which was the March 2000 top. Looking through these, there are essentially six major periods, Q1 1991, Q4 1998, Q4 2002 and Q2 2003, Q1-Q2 2009, and Q2 and Q4 2020. Using one of the dates from each period, here is how the most recent example, from December 14, 2023, compares.

Given this, the odds are in favor of investors committing new capital to small-cap stocks. In every instance but one, forward 52-week returns were strongly positive.

There are several reasons why small-cap stocks could see an improvement in relative performance besides the still large performance gap with the larger-cap indices.

In Figure 7, Jim plots the Russell 2000s relative price-to-earnings ratio to the S&P 500. As seen below, the cheapness of small caps is at an extreme level only reached once before, in the post-1987 period.

Figure 7: Russell 2000 Relative P/E to S&P 500

This discounted relative valuation persists, even though, if current Wall Street estimates hold, the Russell 2000 is forecast to grow both sales and earnings faster next year than is forecast for the S&P 500. Furey Research demonstrates this graphically in Figure 8. In addition, the Russell 2000 is coming off two years where earnings actually fell, creating very easy year-over-year comparisons for 2024.

Figure 8: Earnings and Sales Growth Russell 2000 versus S&P 500

The main question is, “Will small-cap companies be able to report financial results that match current Wall Street estimates?” A key to this will be whether the Fed is able to engineer a soft landing for the US economy or not. Obviously, there are many factors influencing this, including the current US election. So far, the Fed has been successful as the Consumer Price Index (CPI) has fallen while job openings have remained relatively strong, especially for an interest rate tightening cycle (see Figure 9). This should be viewed as a success for the Fed as it has cooled the labor market thus far without triggering a recession.

Figure 9: Consumer Price Index and Job Openings

If there is a risk to the US economy and, therefore, small-cap earnings estimates, it is the potential fall off in consumer spending. Consumer credit has been rapidly slowing as demonstrated by the green line in Figure 10 from Furey Research. If US consumers stop spending, it is likely the US economy will slow to such a degree that earnings estimates for 2025 will need to be revised down greatly.

Figure 10: Consumer Credit

If the FOMC does cut rates as expected, this could begin a bullish period for small-cap stocks. The Russell 2000 has done better than the S&P 500 in four of the past instances when rate cuts began. In fact, on average, over the last five rate-cutting cycles, small-cap stocks have outperformed large caps by approximately 700 basis points as shown in Figure 11.

Figure 11: S&P 500 and Russell 2000 Performance Following Fed Rate Cuts

The key will be the performance of four sectors: Health Care, Financials, Industrials, and Technology. These account for around two-thirds of the Russell 2000. Except for Technology, the other heavyweight sectors have made convincing moves out of 3–6-month periods of consolidation over the past three weeks, as seen in Figure 12.

Figure 12: Weekly Charts of Small Cap Health Care, Financial, Industrial, and Technology ETFs

In conclusion, small-cap investors have had to endure a historic level of underperformance relative to large-cap stocks. However, on both fundamental earnings and sales growth, and relative valuation perspectives, the odds favor a reversion trade where small outperforms large by a substantial margin over a reasonable period. We encourage investors to diversify some of their large-cap profits into small stocks.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Co., an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.

Read the full article here