Key takeaways

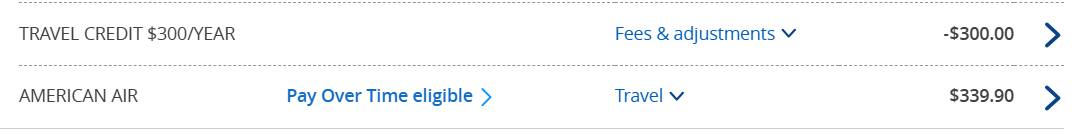

- As one of the most popular travel credit cards available, Chase Sapphire Reserve® comes with valuable benefits, such as its $300 annual travel credit, which helps to offset its high annual fee.

- The annual travel credit is easy to use and applies to a wide range of travel purchases, including flights, car rentals, hotels, cruises and more. This standout benefit does not roll over to the following year.

- In order to maximize the travel credit, use it as soon as possible to start earning bonus rewards on travel purchases. Double-check the merchant category codes associated with your transaction to ensure your purchases are eligible for the travel credit.

The Chase Sapphire Reserve®: it’s a cult favorite, the world’s first viral credit card and one of the best travel credit cards on the market. It took the credit card world by storm when Chase introduced it in 2016. Since then, it’s endured as one of the best credit cards around despite its steep $550 annual fee.

However, that annual fee is substantially offset by the card’s $300 annual travel credit. Here’s what to know about this credit and which travel purchases are eligible so you can take full advantage of this premium perk.

What is the Chase Sapphire Reserve travel credit?

The Chase Sapphire Reserve’s $300 annual travel credit is one of the card’s most valuable benefits. It’s an annual card benefit, so it’s separate from the card’s first-year welcome offer of 60,000 points after spending $4,000 within three months of account opening. You get the travel credit annually just for being a cardholder, and it applies to all qualifying travel purchases paid for with the card. Further, you might be pleasantly surprised at how much qualifies as an eligible purchase.

Bankrate credit cards writer, Ryan Flanigan, has had the Chase Sapphire Reserve card since it debuted and uses it to cover his travel expenses each year.

I love that the annual travel credit covers a wider range of travel-related expenses than I’ve found on any other card… But just having the flexibility to cover an expense I wouldn’t otherwise be able to makes it the most valuable annual travel credit available.

— Ryan Flanigan, Bankrate credit cards writer

The $300 travel credit is a use-it-or-lose-it benefit. If you don’t use it one year, you’ll forfeit any portion that remains at the end of your cardmember anniversary year — it won’t roll over. That’s the last thing you want to happen because you won’t earn bonus rewards on travel purchases until you’ve used the $300 travel credit. The full credit is at your disposal as soon as you open your account, though, so you can start taking advantage of it right away.

How do you earn the Chase Sapphire Reserve travel credit?

The annual travel credit resets each year. But unlike similar credits on top-tier travel cards — like the up to $200 in airline fee credits that come with The Platinum Card® from American Express — the timing is based on your card renewal date instead of the calendar year.

The Chase Sapphire Reserve’s credit is also much easier to use since it isn’t tied to a specific airline or travel provider. With the Amex Platinum, for instance, you have to commit to one airline carrier at the beginning of the year, and you can’t switch later on if your travel plans change.

If you already have the Chase Sapphire Reserve, chances are good that you’ve already used at least a part of your travel credit. But if you’re not sure where you stand, log in to the Chase Ultimate Rewards portal and check your dashboard. You can also confirm when your travel credit resets so that you can plan your purchases accordingly and make sure no portion goes unused.

EXPAND

What counts toward the travel credit

One of the best parts of this travel credit is that Chase’s travel rewards category encompasses a broad range of purchases, including (but not limited to):

- Flights

- Car rentals

- Hotel and motel stays

- Cruises

- Eligible discount travel sites

- Public transportation, such as trains, buses and taxis

- Toll bridges and highways

- Parking lots and garages

- Timeshares

- Travel agencies

What doesn’t count toward the travel credit

Unfortunately, not all travel-related purchases are eligible for reimbursement under this credit. Common airline charges like in-flight purchases won’t count, for example.

Here’s a list of ineligible purchases for your $300 travel credit:

- In-flight goods and services

- Onboard cruise line goods and services

- Sightseeing activities, excursions and tourist attractions

- Merchants located within hotels and airports

- Educational merchants arranging travel

- RV and boat rentals

- Public campgrounds

- Merchants that rent vehicles for the purpose of hauling

- Real estate agents

- Gift cards

- Merchants that sell points or miles

For more information about Chase’s travel rewards categories, see your Sapphire Reserve card’s terms and conditions.

How do you redeem the Chase Sapphire Reserve travel credit?

Thankfully, redeeming the $300 travel credit is as easy as swiping your card like you normally would. Chase automatically issues a statement credit equal to the amount of all eligible travel purchases made with the Chase Sapphire Reserve (yes, it’s really that simple). Travel purchases and corresponding credits generally post to your account on the same day, and you should see them reflected in your statement within one to two billing cycles.

EXPAND

Note that if you make a qualifying transaction within one annual period, but it posts after that period ends, the statement credit will count toward the following year’s $300 travel credit benefit.

How to maximize the Chase Sapphire Reserve travel credit

First, don’t let the $300 annual travel credit go to waste. The Chase Sapphire Reserve carries a hefty $550 annual fee, so you’ll want to squeeze as much value as possible if you want the card to be worth it. Using the full amount of the travel credit means you’ll recoup more than half the cost of keeping the Reserve in your wallet. And considering all that qualifies as travel, you won’t necessarily have to do anything extra outside of your regular spending to earn that $300 credit, making it a pretty easy way to offset a good chunk of the annual fee.

Pair it with other card benefits

Get the most from your Sapphire Reserve card and its $300 travel credit by pairing it with the other valuable card benefits.

- Hang out in one of the Priority Pass or Chase Sapphire Reserve airport lounges before your flight.

- Apply for Global Entry or TSA Precheck.

- Book a hotel stay through The Edit for a $100 property credit.

- Use your 2-year complimentary Lyft Pink All Access membership for ride shares (activate by Dec. 31, 2024).

By stacking your benefits, you’ll squeeze every last drop of value from your Reserve card and make the annual fee worth it.

Use the travel credit as soon as possible

Like earning a pile of points from a welcome bonus, it makes sense to want to save the travel credit for a special trip. But even if you have an upcoming vacation on the calendar, make a point of using the $300 as soon as possible — both when you first sign up for the card as well as when the credit resets on your account anniversary. You aren’t able to start earning travel-related bonus rewards until the credit runs out, so you could be missing out on earning boosted rewards on travel purchases by waiting to use it.

That said, if you’ve already used up the full $300 credit and your cardmember anniversary is right around the corner, you may want to hold off on making a qualifying travel purchase until then so that it counts toward next year’s travel credit.

Get creative with using the travel credit

There’s no single right way to use the travel credit. It’s best to simply spend the credit as soon as possible so you can start earning bonus points on travel. There are several good ways to get the credit — you can go on a trip, book a future journey or even take a staycation at a nearby hotel. Or you can spend the credit on transportation around your area. Here’s how Flanigan uses his $300 travel credit:

“If I have a planned hotel stay at a property where I can’t use points, I’ll save it for that booking. I’ve also used it for train travel outside the United States in the past. Airport parking always ends up being one of my biggest expenses on the many trips I take and it’s the only card of the many I have that bonuses airport parking as a travel purchase.”

— Ryan Flanigan, Bankrate credit cards writer

Double-check which purchases qualify

If you find yourself struggling to break the $300 threshold, you can find out whether a purchase will or won’t qualify by familiarizing yourself with merchant category codes — or MCCs. An MCC is a four-digit number used to classify a business’s products and services. This is how Chase tracks your rewards earnings for its credit cards.

Sometimes, a purchase you think should be eligible for a credit or bonus rewards won’t be (and vice versa). For example, many airports are owned by a government entity. So while you might assume that parking fees will be coded as travel, they may instead be classified under “government services.” You may be able to reference the Visa Merchant Data Standards Manual to look up a business’s MCC and know ahead of time whether a particular purchase will qualify.

The bottom line

Frequent travelers can find a lot of reasons to love the Chase Sapphire Reserve, including its $300 annual travel credit. It’s also one of the most flexible credits available among all luxury travel cards.

If you’re able to take full advantage of the Chase Sapphire Reserve’s $300 travel credit and other valuable card benefits — including Priority Pass Select membership, up to $100 in statement credits for Global Entry, TSA PreCheck or NEXUS and trip cancellation/interruption insurance — you should find it easy to earn back that $550 annual fee (and then some).

Read the full article here