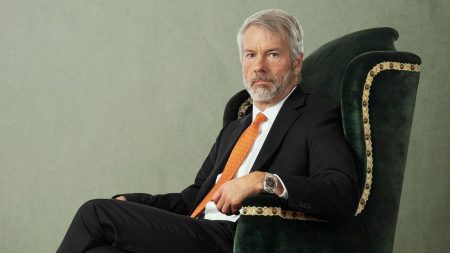

Most people dismiss billionaire Michael Saylor’s publicly traded MicroStrategy as a giant, risky bet on bitcoin. A closer look reveals a masterwork that’s a blueprint for manipulating traditional finance to harness the pixie dust fueling crypto mania. By Nina Bambysheva, Forbes Staff New Year’s Eve at Villa Vecchia is a…

Key takeaways Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments Paying off credit card debt with a personal loan may not be right for you if you’re overwhelmed by…

Everyone has spending limits—even the government. Believe it or not, though the American government has a habit of spending like it’s going out of style, there’s actually a limit to the amount of debt it can take on. This limit is called the debt ceiling. And since 1960, the government…

Improving your financial literacy is a constant journey. But with the start of a new year, there is no better time to focus on it a little more to start the year refreshed. A strong foundation in money management can help you make smarter decisions, avoid common pitfalls, and achieve…

Personal Finance

A perfect storm is brewing for millions of federal student loan borrowers, who may experience dramatic increases in their monthly…

As the Biden administration exits Washington, President-elect Donald Trump inherits a federal student loan system that looks much different than…

Republican lawmakers in Congress are circulating a number of proposals to cut federal spending as part of a massive bill…

Washington is abuzz over whether Congress will address President-elect Donald Trump’s ambitious policy agenda in one bill or two. But…

Featured Articles

Credit Sesame reveals how the minimum payment trap can lead to costly debt and signal deeper financial trouble. New data from the Federal Reserve Bank of Philadelphia found that the percentage of credit card customers making just the minimum payments on their cards has reached…

Dept Managmnt

Key takeaways A balance transfer fee is what credit card issuers charge when you transfer debt, usually credit card debt, to another credit…

Banking

No matter how often bank regulators, international standard setters, rating agencies, or financial reform advocates warn banks that climate change is serious, the…

Credit Cards

Key takeaways The Bank of America® Unlimited Cash Rewards credit card offers a flat 1.5 percent cash back on all purchases. Bank of…

All News

Bloomberg / Contributor/Getty Images The Consumer Financial Protection Bureau (CFPB) announced today that a new rule going into effect in October 2025 will cut overdraft fees and end a bank overdraft loophole that has cost Americans billions of dollars each year in unnecessary fees over several years, while benefitting banks.…

Maybe you want to purchase mutual funds to plan for your retirement or another big goal. But deciding which online platform is best for mutual fund investments can be confusing. First things first: Personal finance experts recommend buying the funds directly from the mutual fund company rather than through a…

Key takeaways Business owners with bad credit can still get a business loan, although they may face higher interest rates and fees Business owners with bad credit can explore online lenders, the U.S. Small Business Administration and Community Development Financial Institutions Carefully consider all options and weigh the benefits and…

As the clock continues to tick down, Congressional leaders have finally released the text of a proposed funding measure to keep the lights on. As expected, it’s a short-term bill intended to fund the government through March 14, 2025. Without any action by Friday, December 20, 2024, funding will run…

With interest rates easing and inflation cooling, small businesses are getting a much-needed break. A change to the Small Business Administration’s (SBA) refinancing program will help them take advantage of the shift. The SBA’s recent rule changes to its 504 loan program make it easier for businesses to refinance debt…

Back in the old days, the state and local tax (SALT) deduction was arguably the most popular tax deduction in America. You probably remember your parents or grandparents saving every receipt—even on small purchases like a box of nails or a single heirloom tomato—and stuffing them in a manila folder.…

The holiday season is a time for joy, celebration, and gift-giving. However, it can also bring about financial stress and anxiety, especially if you’re worried about managing your credit card payments amidst the flurry of holiday expenses. To help you navigate holiday spending without missing a beat on your financial…

Key takeaways Contactless payment technology, also sometimes called tap-to-pay technology, works similarly to chip credit cards by providing a one-time code for each transaction to protect personal information. Most major credit card issuers now offer contactless credit cards because they can make transactions faster and safer — and some issuers…

If you’re looking to trade foreign stocks, you need a broker that allows international trading, and not all brokers do. The ability to trade foreign stocks greatly expands the number of companies you can own, and it can be a great way to add diversification to your portfolio. Here are…

Key takeaways Unsecured small business loans don’t require collateral New businesses or those with bad credit may have issues getting approved for an unsecured small business loan Secured small business loans may be easier to get as they are less risky for lenders Many business loans require assets like real…

Editor's Pick