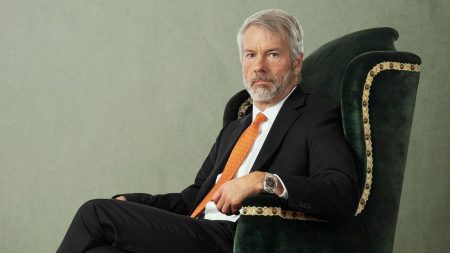

Most people dismiss billionaire Michael Saylor’s publicly traded MicroStrategy as a giant, risky bet on bitcoin. A closer look reveals a masterwork that’s a blueprint for manipulating traditional finance to harness the pixie dust fueling crypto mania. By Nina Bambysheva, Forbes Staff New Year’s Eve at Villa Vecchia is a…

Key takeaways Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments Paying off credit card debt with a personal loan may not be right for you if you’re overwhelmed by…

Everyone has spending limits—even the government. Believe it or not, though the American government has a habit of spending like it’s going out of style, there’s actually a limit to the amount of debt it can take on. This limit is called the debt ceiling. And since 1960, the government…

Improving your financial literacy is a constant journey. But with the start of a new year, there is no better time to focus on it a little more to start the year refreshed. A strong foundation in money management can help you make smarter decisions, avoid common pitfalls, and achieve…

Personal Finance

A perfect storm is brewing for millions of federal student loan borrowers, who may experience dramatic increases in their monthly…

As the Biden administration exits Washington, President-elect Donald Trump inherits a federal student loan system that looks much different than…

Republican lawmakers in Congress are circulating a number of proposals to cut federal spending as part of a massive bill…

Washington is abuzz over whether Congress will address President-elect Donald Trump’s ambitious policy agenda in one bill or two. But…

Featured Articles

Credit Sesame reveals how the minimum payment trap can lead to costly debt and signal deeper financial trouble. New data from the Federal Reserve Bank of Philadelphia found that the percentage of credit card customers making just the minimum payments on their cards has reached…

Dept Managmnt

Key takeaways A balance transfer fee is what credit card issuers charge when you transfer debt, usually credit card debt, to another credit…

Banking

No matter how often bank regulators, international standard setters, rating agencies, or financial reform advocates warn banks that climate change is serious, the…

Credit Cards

Key takeaways The Bank of America® Unlimited Cash Rewards credit card offers a flat 1.5 percent cash back on all purchases. Bank of…

All News

Key takeaways The JetBlue TrueBlue program is ideal for anyone who prefers to fly with JetBlue, travels frequently to JetBlue’s service destinations or wants to pool points with other TrueBlue members. The best way to earn and redeem points in this program is by flying with JetBlue. This program offers…

Finding a treasure hidden in an old dresser drawer or the attic is the stuff of dreams. So is rooting through your jars of coins and coming up with a rare one that’s worth serious money. Striking it rich is a remote possibility for folks who have built up a…

Key takeaways Grants can help Black female business owners bridge the funding gap Many grants are tailored to specifically help Black business owners and women business owners overcome racial biases Grants designed to help minority business owners overcome barriers are currently facing legal challenges Additional resources are available, including minority…

#Financial practicePersonal financeCredit1.Saving every monthBuilds financial security, enabling long-term planning and investment opportunities.Establishes an emergency fund, reducing reliance on credit in unexpected situations.2.Paying off credit card balances in fullFrees up money for other expenses or savings instead of paying highAvoids interest charges and improves credit score by maintaining a low…

Filing for bankruptcy is a significant step that can offer relief from overwhelming debt, but it’s not without complexities. The legal process involves intricate paperwork, strict deadlines and detailed knowledge of financial laws. Navigating this maze can be challenging, especially when you are already under financial stress. While some people…

How much student loan debt do you think the average college student racks up by the time they cross the graduation stage? Seriously, take a guess. $10,000? $20,000? You’d be what’s known as wrong. The average college student graduates with a whopping $38,290 of student loan debt.1 Yikes. And that’s just…

Key takeaways Capital One launched its own airport lounge program in 2021 with the release of the Capital One Venture X Rewards Credit Card. Cardholders with the Capital One Venture X Rewards Card and the Capital One Venture X Business Credit Card get free access to Capital One airport lounges.…

Looking for the best stock trading apps to get your money in the market? There’s a growing list of apps to choose from, which can make the search intimidating, especially if you’re just starting to invest. The best stock apps let you quickly trade, track your account in real-time, help…

Key takeaways Lenders provide a variety of farm loans for operating costs, ownership, natural disasters and more Farmers edged out of traditional financing can seek low-cost Farm Service Agency (FSA) loans To apply for a farm loan consider whether you meet the lender’s criteria for experience, credit and down payment…

More Tips to Save Big When Eating OutPart 2 includes 7 tips focused on saving while eating out

Tip 11: Splurge Guilt-Free for Special Occasions Make dining out a special treat by saving it for memorable occasions or celebrations. Establishing a habit of cooking budget-conscious meals at home can lead to significant savings, allowing you to set aside funds for guilt-free restaurant splurges. Engage the entire family in…

Editor's Pick