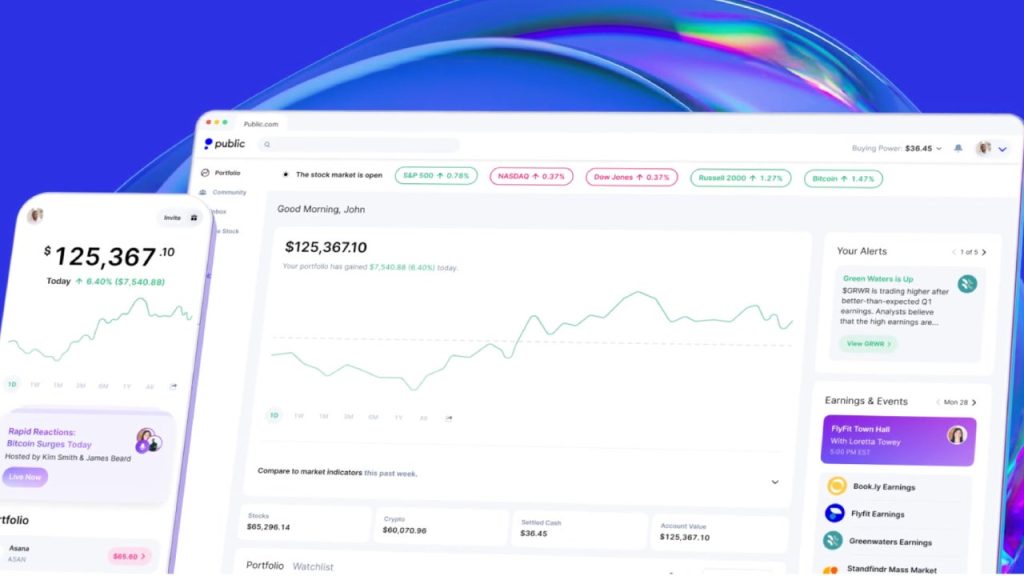

Public is an investing platform that offers a solid trading experience and will likely appeal to investors who are new to financial markets. You’ll get access to lots of educational content that can help beginning investors get up to speed on various topics and with fractional shares, you can start trading with as little as $1 with the Investment Plan feature.

You also won’t have to worry about commissions on stocks, ETFs or options, and it makes bond trading much more accessible, too. Public offers cryptocurrency trading, though there is a transaction fee charged by their crypto partner, as well as the opportunity to invest in non-traditional assets such as luxury goods and contemporary art. A social feed is available to connect with other investors about trade ideas and company executives are sometimes available for investor questions through its “town hall” meetings.

While Public offers much of what will interest a typical investor, you won’t find mutual funds on the app and individual taxable accounts are the only account type offered. Investors looking for a broader brokerage offering should consider traditional brokers such as Fidelity Investments or Charles Schwab.

Best for

- Beginning investors

- Buy-and-hold investors

- Fractional shares

Public at a glance

| Category | Public |

|---|---|

| Minimum balance | $0 |

| Securities tradable | Stocks, ETFs, options, cryptocurrency, bonds |

| Cost per trade | $0 |

| Customer service | Email, chat Monday-Friday 9 a.m.-5 p.m. ET |

| Account fees | $75 for transfers out; $5 inactivity fee every 6 months for accounts with less than $20 |

| Mobile app | The Public mobile app is available on the Apple App Store and Google Play Store. |

Pros: Where Public stands out

Low trade minimum and no commissions

Public makes it astoundingly easy to buy into the market. You’ll need just $1 to get into the game. And you’ll have access to literally thousands of stocks and exchange-traded funds (ETFs), so you’re likely to find that hot stock you want to buy. Public literally can’t lower the bar any further to stock ownership.

As part of its value proposition, Public doesn’t charge any commission. Zero-commission trading is not quite the hook that it was a few years ago when Robinhood started pulling this little trick. Still, it’s good to see that Public meets the standard industry commission structure.

Want to set your trading on autopilot? Public lets you set up an investment plan to buy stocks or funds regularly so you don’t need to worry about it. Premium members receive this feature at no extra cost, though non-paying members will pay $0.49, $0.99 or $1.99, depending on the number of stocks in their investment plan (1-3, 4-10 or 11-20, respectively).

Options pricing

Public has extended its value prop beyond just stocks and ETFs with the addition of options trading. Public offers revenue sharing on options trades, with clients receiving 50 percent of the broker’s revenue on trades, though you’ll need to sign up for the program. The net effect means that (incredibly) you may wind up being paid for your options trades.

For example, Public estimates that clients would receive about $0.18 per contract traded and a net $0.15 per contract, after factoring in regulatory fees, which are assessed at every broker. This pricing structure may well make Public the best options broker out there, among brokers offering free options trades.

Bond trading

Public began offering Treasury securities and corporate bonds in 2023, giving it a presence in the fixed-income world. Trading individual bonds is typically the province of more sophisticated investors, in part because it costs around $1,000 to buy a single bond, making it prohibitive for many individual investors. Public is changing that, and allowing investors to buy a much more manageable portion of a bond in the $100 range, opening up the market to more people.

Public charges a fee of $0.10 to $0.25 for every $100 face value in Treasury bonds, while corporate bonds run $0.35 to $0.50 for every $100 in face value. The bond market is less liquid than the stock market, resulting in wider bid-ask spreads that can cost investors real money.

For investors looking to further diversify their bond holdings, Public offers a Bond Account that requires an initial $1,000 minimum deposit, allowing you to invest in a portfolio of 10 corporate bonds that lock in a set yield at the time of purchase. Note that the bonds offered are of medium credit quality, which means there is an elevated level of default risk associated with them compared to higher-rated options. Investors should assess whether these bonds suit their risk tolerance accordingly.

Fractional shares

Public allows fractional shares on its platform, and that’s a great feature for beginners. With fractional shares, you can buy a slice of even the highest-priced stocks or ETFs. And with the low trade minimum of just $1 with the Investment Plan feature, you can own a piece — albeit a tiny one — of anything. This feature gets every last dollar of your money working for you, regardless of the stock price.

Not only does Public support buying partial shares, but it allows you to reinvest in them, too. So when you receive a dividend, you can set the app to reinvest it into the stock that paid it.

Both features are good for beginners, and not many brokers offer both. In fact, Fidelity, Charles Schwab and Robinhood are some of the only major online brokers that offer both features.

Extensive education and research

Public does a good job of providing a plethora of educational content for beginning investors, including tons of “101” type information on the investing basics. So you’ll be able to read clear articles that explain the basics (“What is a short squeeze?” or “What causes market volatility?”).

You’ll also get an extensive news feed and research on any stock that you want to follow as well as vital financial information, upcoming earnings reports and message boards for each stock. Another great feature: You’ll be able to listen to each company’s earnings calls (live or pre-recorded) or read a transcript of them right from the app, going back four years. It’s a surprisingly detailed offering and compares well to other top trading apps.

Social feeds

One of the more unusual — and interesting — features of Public is the social feed that allows you to follow other investors, scan through featured profiles and engage in some stock chat with them on the platform. So it’s not only stocks you can follow, but people, too. You can see why another investor likes a certain stock and when they might want to buy or sell it.

You can also search through thematically linked stocks (“Home & Garden” or “Women in Charge,” for example) to pull ideas and then see what other investors think. And of course, you can look for the day’s big movers and other similar sorts of pre-screened stocks.

Another cool feature is what Public calls “town halls,” which is a kind of question-and-answer session with CEOs of publicly traded companies, perhaps even one of your holdings. You submit written questions and leaders respond to them in a live forum.

Public Premium subscription

If you’re looking for more news, guidance and analysis than what’s available on a stock’s page, Public also offers Public Premium, a subscription service that costs $8 per month billed annually (or $10 per month billed monthly). That dough gets you more financial metrics to analyze the company as well as other analysis. You’ll also get an upgraded level of customer support from the Public team and the ability to set up an automatic investment plan at no extra cost, as mentioned before.

Customers do have a way to skip the $8 fee, though. Simply have an account with $20,000 and Public will give you access to Premium gratis.

Access to cryptocurrency

In addition to stocks and ETFs, cryptocurrency is also available on Public. The app offers seven of the most popular coins, including Bitcoin, Ethereum and Shiba Inu. Plus, you can invest as little as $1. Public’s partner Bakkt Crypto charges 1.25 percent of the transaction value above $500 and a sliding scale below that. And you’ll also be able to use the app’s social feeds to chat with others about it all.

Cons: Where Public could improve

Lack of mutual funds

If you want to invest in stocks and ETFs, like many investors, you’ll find what you’re looking for here. Throw in the high-risk, high-return potential of options, and this selection will suffice for many investors and maybe most. These securities have enough risk and potential return — you can earn satisfactory profits without other types of investments.

But investors looking for relatively common choices such as mutual funds will have to set up an account elsewhere. That’s the nature of an app that pitches itself to educate beginners on how to invest.

That said, Public does offer cryptocurrency trading and access to non-traditional assets such as fine art, NFTs, rare trading cards, comics, music royalties and even rare sneakers. A robust offering in these categories makes Public basically unlike any traditional online discount broker.

Limited account types

You’ll already have created your account before you realize that you weren’t even asked for the account type. That’s because Public offers only the most straightforward option here: an individual taxable account. That’s probably not a dealbreaker for the kind of people Public is looking to attract, but many others won’t find it to their liking and may eventually go elsewhere. Investors looking to save for retirement through tax-advantaged accounts such as traditional and Roth IRAs will have to open an account with another broker.

Bottom line

With its focus on education in an easy-to-use app, Public offers a solid package to beginners in the investing game:

- The educational and social elements will help newer investors engage with investing and offer them a reason to come back to the app even if they aren’t trading.

- Beginning investors should appreciate no account minimum, fractional shares and more.

- Those looking to trade options may find the commission structure here attractive and the access to bonds at a lower investment minimum may prove appealing.

Investors looking for brokers with strong educational offerings should check out Fidelity, Charles Schwab and Merrill Edge. Those needing more types of accounts could choose almost any other broker, though some of the larger players such as E-Trade will provide a wider selection.

— Bankrate’s Logan Jacoby contributed to an update of this story.

-

Bankrate is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate does not include all companies or all available products.

Read the full article here