It isn’t always easy to make sense of the short-term equity market gyrations. Last week’s downturn came with virtually no change in the outlook for 2.5% Q1 real (inflation-adjusted) U.S. GDP growth and the chance of recession in the next 12 months, as tabulated by Bloomberg, remained at 35%.

Still, market participants appear desperate for any excuse to throw cold water on stocks.

Minneapolis Fed President Neel Kashkari seemingly offered some support to that effort last Thursday when he contributed to a major U-turn in the southernly direction. Mr. Kashkari, who sees two cuts in the Fed Funds rate this year said that if there is no additional progress on inflation, “that would make me question whether we needed to those rate cuts at all.”

But I find Fed Chair Jerome H. Powell’s statement earlier in the week most germane, “The recent data do not…materially change the overall picture, which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down to 2% on a sometimes-bumpy path,” and that Fed economic projections from last month are hardly unreasonable.

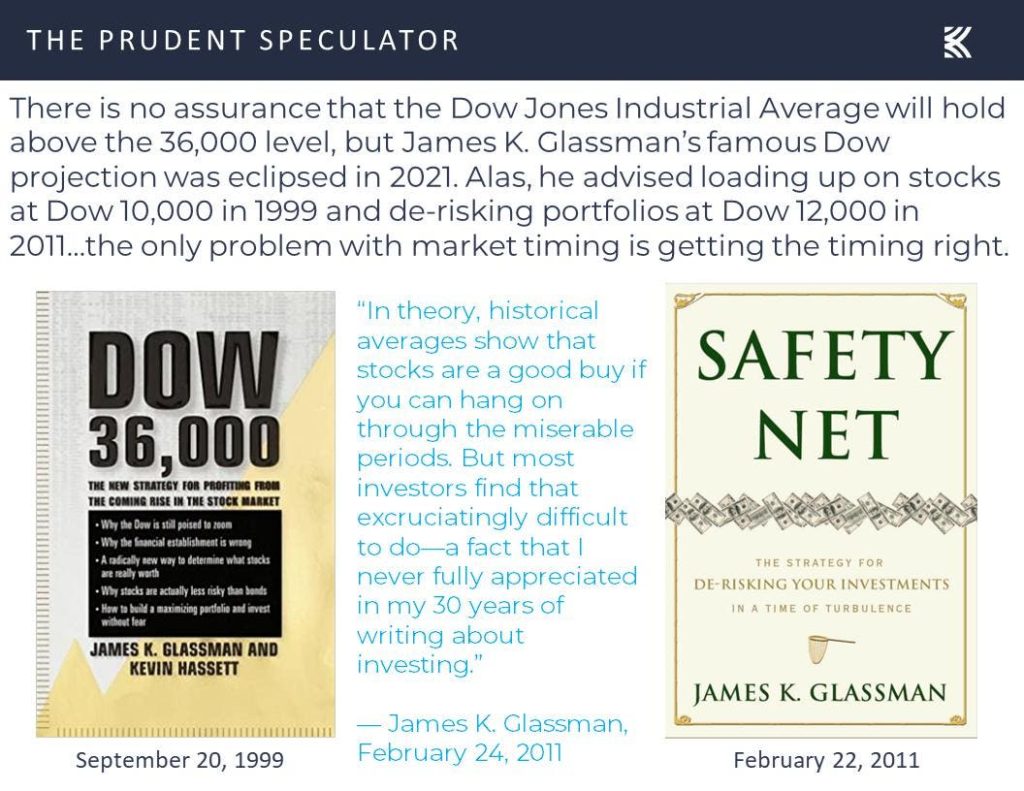

While the Dow Jones Industrial Average failed in its effort to break the psychologically important 40,000 level, instead dropping below 39,000, that popular benchmark still sits some 35% higher than the recent Bear Market low set on September 30, 2022. What’s more, the gauge has returned 536% on a total-return basis, or 7.83% per annum, since James K. Glassman published his supposedly wildly Bullish Dow 36,000 tome back in 1999.

So, while I am braced for additional downside volatility, I think it worthwhile to reflect on how rewarding equities have been in the fullness of time for those who remember that the secret to success in stocks is not to get scared out of them.

HEALTH INSURERS CATCH A COLD

For those who seek to practice a Value-oriented investment philosophy, I also highlight a health insurance stock that was sold off on the heels of the latest ruling by Uncle Sam.

Elevance Health (ELV) slid in price as the Centers for Medicare & Medicaid Services (CMS) broke recent precedent in leaving its preliminary payment proposal for Medicare Advantage plans unchanged. CMS proposed in January to increase benchmark payments to insurers by 3.7%, below the risk score trend of 3.86%, leading many to expect an upward adjustment by the finalization deadline in April.

The government suggested that private Medicare insurers would remain healthy despite the risk projections and that the transition from ICD-9 to ICD-10 billing codes would make payments more transparent and reduce overpayments prevalent in previous years. In the announcement, CMS also responded to claims by Medicare Advantage providers that rising utilization demanded a higher payment bump. The agency noted that while the utilization trends since 2020 has been higher (on account of the precipitous drop in utilization during the pandemic), 2023 utilization was below pre-pandemic forecasts for the same year.

The news likely will trigger analysts and management teams to revise their earnings forecasts lower for the coming years, as Medicare Advantage had been a solid growth opportunity in the recent past. But I view these developments to be less consequential for ELV, as it has relied less on Part C plans to drive growth than some peers.

Indeed, Elevance has launched a pharmacy benefit management platform and boasts deep penetration of local markets throughout the 14 states in which it is an exclusive licensee of the Blue Cross Blue Shield brand. The P/E for ELV is just 13.7 times the NTM EPS forecast, with 12% growth predicted in each of the next three years.

This is a condensed version of a full-length article posted 4.8.2024 on theprudentspeculator.com. The Prudent Speculator’s weekly commentary is curated each week as a valuable resource for recent stock market news, investing tips and economic trends. To receive regular reports like this one along with free stock picks sign up here: Free Stock Picks – The Prudent Speculator.

Read the full article here