Copper is the hot metal for investors thanks to a 38% price rise over the last 12 months but there is another industrial metal, tin, which has also risen by 38% with a repeat of past price blowouts possible.

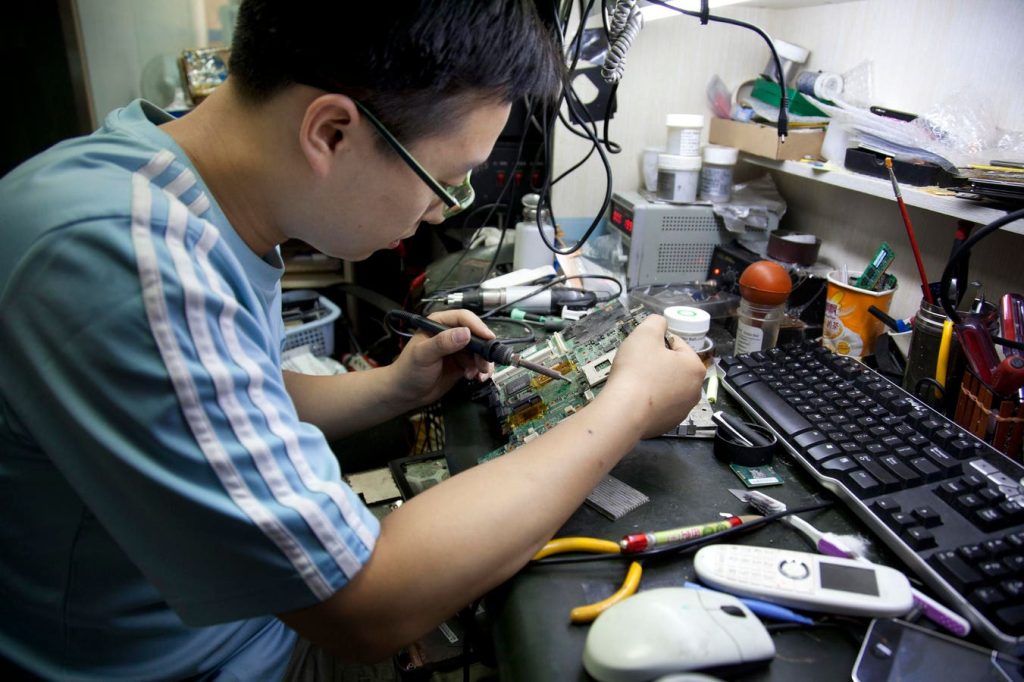

Often overlooked because of its reputation as one of yesterday’s commodities, tin is undergoing a revival as a metal critical to a range of technologies, including solder in electronics, solar panels and as a protective barrier in batteries.

Tin is also the “smallest” of the base metal family with annual global production of around 380,000 tons, a fraction of copper’s 22 million tons.

Whereas copper’s use is measured in tons, tin is measured in ounces with a little added to an infinite variety of applications, earning it the cookery nickname of “the spice element”.

As well as being produced in relatively small volumes which can lead to sudden price spikes in a shortage there are only a handful of major producers, China, Myanmar, and Indonesia followed by Bolivia, Peru and Malaysia.

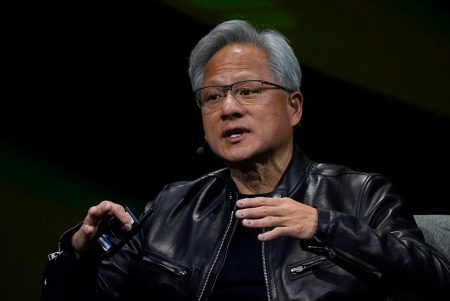

With most tin from Myanmar and Indonesia earmarked for China the reality of the tin market is no different to a number of other metals seen as critical for the electronics industry and emerging technologies. China is in control.

The small production base and importance of tin led to a 210% price spike in between 2020 and 2022 when the Covid outbreak was followed by Russia’s invasion of Ukraine.

Boom, Bust, Boom

From around $15,000 per ton, tin soared to $48,000/t returning to $18,000/t before starting its latest upward surge to $34,500/t.

The latest price increase has sparked investor interest in plans to restart the once great tin mines of Cornwall in the south-west of England where London-listed Cornish Metals is working toward the redevelopment of the South Crofty mine which closed in 1998 after producing tin for 400 years.

Geopolitics as much as the easier-to-understand laws of supply and demand are the keys to the tin market — along with the occasional dash of outright manipulation as occurred in 1985 when a producers cartel called the International Tin Council collapsed while trying to prop-up the price.

The failure of the ITC bruised the reputation of the London Metal Exchange and banks which had been trading in tin, believing that the Council could maintain a “pegged” price even as the metal was falling in open trade.

For some investors the near collapse of the tin market so coloured their view of the metal that they continue to treat it with suspicion.

But this time it’s the fundamentals of the tin market which look attractive with demand from traditional uses being boosted by modern electrical demand bumping into tight supply and effective Chinese control of the market.

Chinese metal is largely consumed locally while Myanmar’s tin from the big Man Maw mine slips across the border into China, if available which it currently isn’t because the mine is in the rebel-controlled State of Wa on the border with China.

Adding to tension in the tin market is uncertainty about the supply of Indonesian metal which was interrupted earlier this year by the slow issuing of government mining approvals.

Supply Shocks

Supply shocks are compounding the effect of increased demand from the electronics industry which promises to become the primary consumer of tin, a metal used for more than 5000 years, combining with copper to make bronze.

Mineral intelligence consultancy BMI expects the tin price to continue rising, possibly reaching $37,000/t in 2033.

But, given the track record of tin surging sharply higher when supply disruption bumps into strong demand, that price tip could prove to be conservative.

Read the full article here